Published at block height 907070

The world is experiencing a fundamental monetary shift driven by technology that demands strategic attention at every level of society. Bitcoin is no longer a fringe experiment – it’s reshaping national policies, corporate strategies, and individual freedoms in ways that decision-makers can no longer afford to ignore.

Bitcoin creates strategic stakes across three interconnected levels: national sovereignty and competitiveness, corporate and organizational strategy, and individual financial rights.

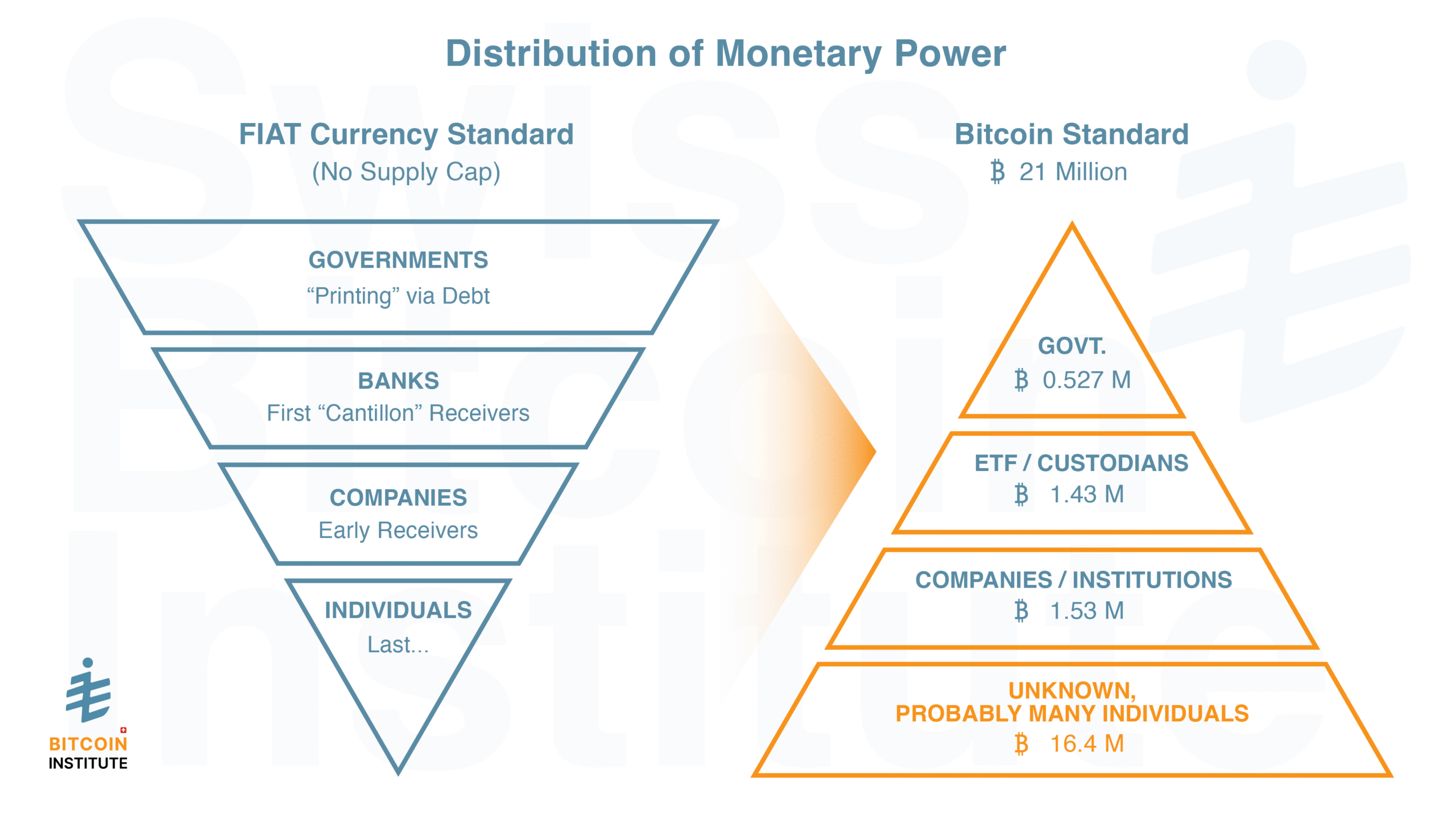

Figure 1: Distribution of monetary power in the two systems, fiat currency and Bitcoin.

Sovereignty and Competitiveness on National Level

Countries worldwide are grappling with Bitcoin’s implications for monetary policy, energy strategy, and international competitiveness. The U.S. is establishing a national Bitcoin reserve, El Salvador has made Bitcoin legal tender, and BRICS nations are exploring Bitcoin and alternative monetary systems to reduce dependence on traditional Western financial infrastructure aka the US Dollar. Government entitites collectively hold 527,000 BTC (2.5%).

Switzerland faces critical decisions about its position in this new landscape—from SNB policy considerations to energy grid integration, from regulatory frameworks to talent attraction. The question is not whether Bitcoin will impact Swiss policy, but whether Switzerland will lead or follow in shaping the global Bitcoin economy.

Disruption and Opportunity on Corporate and Organizational Level

Forward-thinking organizations are already integrating Bitcoin into their strategies. The Top100 Bitcoin-holding corporations around the globe collectively hold 854,000 BTC in their treasuries. Financial institutions are developing custody services and Bitcoin-backed products. Energy companies are exploring Bitcoin mining as a grid balancing solution and methane emission reduction tool. Meanwhile, non-profits are leveraging Bitcoin for financial inclusion and humanitarian aid in regions with restricted banking access. Organizations that fail to understand these shifts risk being blindsided by competitive disadvantages or missing transformational opportunities.

Financial Sovereignty and Human Rights on Individual Level

Bitcoin represents the first truly global, neutral monetary system that operates independent of any government or corporation. For individuals in countries with capital controls, hyperinflation, or authoritarian regimes (5.5B people), Bitcoin provides financial sovereignty and freedom of transaction. Even many stable democracies are plagued by high levels of debt and inflation, making their citizens increasingly question traditional monetary policy and seeking alternatives to preserve purchasing power. This shift in individual financial behavior will have profound implications for how organizations serve their stakeholders. About 16,400,000 BTC or 82% of all BTC in existence today are not held by government or organisations, but by individuals directly (ETFs account for another 1,400,000 BTC).

The Knowledge Gap: A Strategic Risk for Decision-Makers

These interconnected changes create a complex landscape where traditional expertise falls short. Government officials need to understand Bitcoin’s implications for monetary sovereignty, energy policy, and international competitiveness—but most Bitcoin resources focus on investment rather than policy. Corporate executives need strategic intelligence about regulatory developments, competitive positioning, and implementation strategies—yet they can’t dedicate the time to become Bitcoin experts themselves.

The challenge is that Bitcoin operates at the intersection of technology, economics, energy, policy, and human rights. Understanding its full implications requires interdisciplinary expertise that most organizations lack internally. Yet the decisions being made today about Bitcoin may shape competitive positioning on all levels for decades to come.

Introducing the Swiss Bitcoin Institute

The Swiss Bitcoin Institute (SBI) was founded to address this critical knowledge gap. As Switzerland’s first dedicated Bitcoin think tank and education hub, we serve decision-makers who need authoritative, actionable insights about Bitcoin’s strategic implications—not cryptocurrency speculation.

The SBI aims to become your trusted human curator and synthesizer of strategic Bitcoin knowledge, not just an information provider. – Marcus Dapp

We recognize that busy professionals need specific analysis that considers Switzerland’s environment, political system, and economic strengths. You need research that cuts through the noise to deliver evidence-based insights, and you need education that respects your expertise while building Bitcoin literacy efficiently.

Our Strategic Approach

Independent Intelligence: Our nascent network of SBI Fellows, which I will introduce in a next post, are going to produce original research covering the larger Bitcoin ecosystem, ranging from geopolitics to technology, from energy&climate to human rights and more. We monitor trends in economics, policy, and technology development to provide the intelligence you need to anticipate changes affecting your organization.

Executive Learning: Educating decision-makers, who are experts in their field but do not have the time to deep-dive into Bitcoin is a challenge. At the same time, the SBI not only has deep Bitcoin expertise but also decades-long experience in explaining complex issues and designing effective curricula. We will provide a range of customized formats, from 1:1 coaching and exclusive dinner talks to executive briefings to more formal course formats that meet executives at eye-level and cater to their specific needs. I will detail out the offering in a next post as well.

Strategic Speaking: Through keynotes, workshops, and executive briefings, we translate complex Bitcoin implications into actionable strategic intelligence for different sectors. In engaging talks, we provide the independent, evidence-based perspective that enables leadership teams to take a new perspective when evaluating Bitcoin opportunities and risks. Whether addressing your board, management team, or clients, or donors, or stakeholders, we deliver the credible expertise that transforms Bitcoin uncertainty into strategic clarity.

Switzerland’s Bitcoin Opportunity

The Bitcoin transition is gaining pace globally – but at different local speeds. Switzerland’s success as a financial hub, combined with a tradition of innovation, political stability, and direct democracy, uniquely positions the country to lead in the Bitcoin era. Our regulatory pragmatism, deep-rooted independence, and commitment to neutrality align naturally with Bitcoin’s decentralized principles.

Competitive advantage requires more than favorable conditions—it demands informed leadership. Among nations, Switzerland has a nearly unique opportunity to position and establish itself in the next monetary era. The SBI provides the strategic intelligence that transforms this national opportunity into an effective advantage.

The future depends on today’s decisions. Make them with confidence. We are here to help.