Published at block height 910842

Executive Summary

The Bitcoin ecosystem has evolved far beyond its original on-chain payment mechanism, developing into a sophisticated multi-layered payment stack. What began as a single method for transferring value has expanded into a diverse array of complementary systems, each optimized for different use cases and requirements. While often considered to be competing solutions, these diverse approaches form an interconnected ecosystem that collectively extends Bitcoin’s utility across a broader spectrum of payment scenarios.

This intelligence brief examines the current state of Bitcoin’s payment infrastructure, analyzing five key systems across four critical dimensions: privacy, time to finality, economic efficiency, and trust requirements. The analysis reveals that apparent competition between different approaches masks a deeper complementarity. Each system addresses specific market needs, while anchoring their security on-chain, and remaining interoperable through the Lightning Network as connecting infrastructure.

The payment stack demonstrates remarkable architectural diversity while maintaining underlying coherence through shared Bitcoin security assumptions and Lightning interoperability. This evolution represents not merely technological advancement but a fundamental expansion of Bitcoin’s addressable market, enabling use cases ranging from high-frequency micropayments to large-value private transfers.

The Evolution of Bitcoin Payments

When I first encountered Bitcoin in 2009, what captured my imagination was not its potential as a speculative asset, but rather its promise as an internet-native payment system. The whitepaper described a peer-to-peer electronic cash system that could enable direct value transfer without traditional financial intermediaries. This vision motivated my dissertation research on scaling Bitcoin for global adoption, a challenge that has shaped much of my subsequent work.

The original Bitcoin protocol, while revolutionary, has significant limitations when applied to everyday payment scenarios. On-chain transactions require global consensus through proof-of-work mining, resulting in settlement times measured in tens of minutes and transaction fees that make micropayments economically unfeasible. During periods of network congestion, these limitations become particularly acute, with fees occasionally exceeding the value of small transactions entirely. For example the fees during the 2017 bull market sometimes crowded out any payment below 10USD in value due to high fees.

The recognition of these constraints sparked what can be understood as the first major architectural innovation in Bitcoin’s history: the development of payment channels. The concept emerged from the understanding that not every transaction required global settlement if parties could establish cryptographic guarantees about final settlement. This insight led to unidirectional payment channels, which allowed parties to conduct multiple transactions while requiring only two on-chain operations: opening and closing the channel. The close transaction represents the aggregate of all payments performed on the channel.

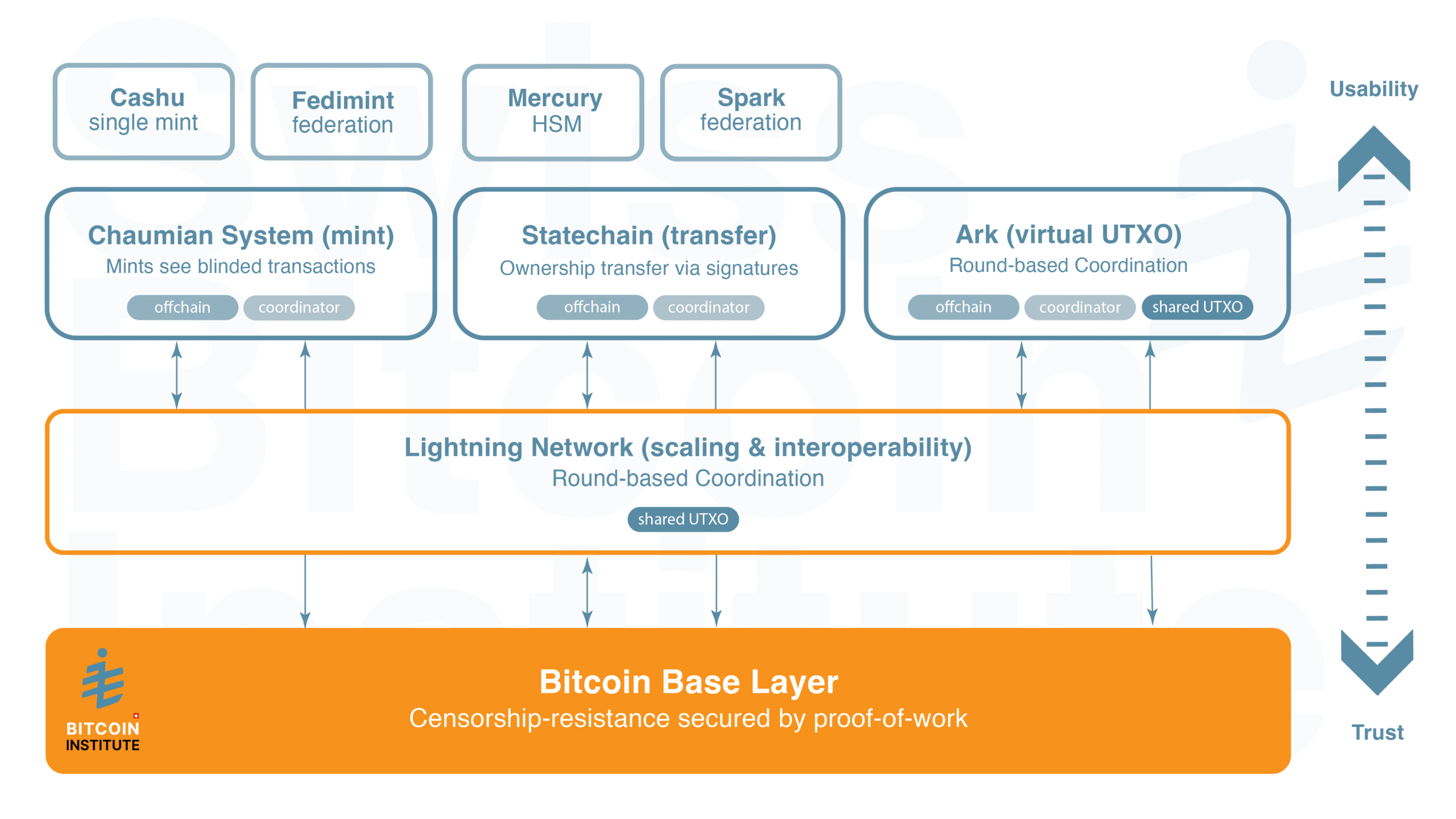

The evolution from unidirectional to bidirectional channels represented a crucial breakthrough that enabled the Lightning Network’s development. However, this progression also highlighted a fundamental tension that continues to influence Bitcoin payment system design: the trade-off between maintaining Bitcoin’s trustless properties and achieving practical usability improvements. Each subsequent innovation has navigated this tension differently, leading to the diverse ecosystem we observe today (c.f. figure 1). Alongside Lightning’s development, alternative approaches emerged that recognized that different use cases might justify different trust models, particularly when enhanced functionality or improved user experience could be achieved through careful consideration of tradeoffs. This recognition has proven prescient, as adoption patterns demonstrate clear market segmentation based on user preferences and requirements.

Figure 1: Overview of the Bitcoin Payment Stack

In the following we will analyze five payment systems – Bitcoin On-Chain, Lightning Network, Ark, Statechains and Chaumian eCash – by taking a closer look at privacy, time to finality, economic efficiency and trust requirements

Bitcoin On-Chain: The Security Foundation

On-chain Bitcoin transactions represent the foundation layer upon which all other systems ultimately depend. This base layer prioritizes security and censorship resistance above all other considerations, establishing the trust anchor that enables higher-layer innovations. While there are systems that extend the expressiveness, we only consider the traditional payment use-case in this report.

Transaction finality is achieved by having miners include the transaction into their blocks to extend the blockchain. Since mining is a probabilistic process, transactions get a confirmation every 10 minutes in expectation. The number of confirmations required varies based on transaction value and risk tolerance, and for large amounts, where the irrevocability of the transaction is paramount, it can easily exceed one hour.

Privacy characteristics of on-chain transactions remain limited despite common misconceptions. While addresses provide pseudonymity, sophisticated blockchain analysis techniques can often correlate transactions and link them to real world identities. The permanent and public nature of the blockchain creates a comprehensive audit trail that becomes increasingly analyzable as data science techniques advance. This limitation has driven privacy-focused innovations in higher-layer systems.

The economic model of on-chain transactions creates clear use case boundaries. Fixed transaction fees, regardless of transferred amount, make micropayments economically unfeasible during periods of network congestion. However, for large-value transfers, on-chain transactions provide unmatched security assurances at reasonable cost. This economic dynamic naturally segments use cases, with on-chain transactions serving as settlement rails for higher-layer systems rather than general-purpose payment infrastructure.

The trust requirements for on-chain transactions extend only to the network’s consensus mechanism and the cryptographic assumptions underlying Bitcoin’s design. Users need not trust any specific counterparty or service provider, though they must accept the probabilistic nature of proof-of-work consensus. This trust model establishes the baseline security guarantee that all other systems reference, either directly through anchoring mechanisms or indirectly through interoperability protocols.

Lightning Network: The Scaling Innovation

The Lightning Network addresses many of on-chain Bitcoin’s limitations through a network of bidirectional payment channels that enable instant, low-cost transactions while preserving Bitcoin’s fundamental security properties. Payments achieve near-instant finality, with routing typically completing within seconds when successful paths exist through the network topology.

Privacy characteristics in Lightning represent a significant improvement over on-chain transactions, though they remain imperfect. The system employs onion routing similar to the Tor network, ensuring that intermediate routing nodes cannot determine payment origins, destinations, or amounts. However, payment metadata remains visible to nodes along the routing path, and sophisticated analysis of payment flows can potentially compromise privacy through traffic correlation attacks. These limitations have spurred ongoing research into improved routing protocols and payment decorrelation.

Lightning’s economic efficiency transforms Bitcoin’s utility for frequent, small-value transactions. Once channels are established, payments incur minimal fees related to routing rather than mining, making micropayments economically viable. This efficiency comes from the fact that once a channel is set up, all the participants do is negotiate which party owns which part of the funds in the channel. The Lightning network is a so-called shared UTXO system, in which immobilized funds sent to a multisignature address, co-owned by all the protocol participants, are moved between participants by updating a shared settlement transaction.

While great for real-time interactions, and low-cost transactions, this efficiency comes with operational complexity related to channel management, liquidity allocation, and routing reliability. Users must consider channel capacity constraints and maintain sufficient inbound and outbound liquidity to support their transaction patterns.

The trust requirements in Lightning remain minimal compared to custodial alternatives, though they differ from on-chain transactions. Users must trust channel counterparties not to broadcast revoked states and must maintain sufficient monitoring to detect and respond to potential breaches. Additionally, successful routing depends on the honesty and reliability of intermediate nodes, though cryptographic mechanisms ensure that dishonest routing cannot result in fund loss, only payment failure.

My involvement in Lightning development stems from recognizing its potential as connecting infrastructure between diverse Bitcoin payment systems. Lightning’s architecture enables atomic swaps and cross system transactions, allowing users to move value seamlessly between different payment protocols. This interoperability transforms Lightning from merely another payment system into the connective tissue that unifies Bitcoin’s broader payment ecosystem.

The network effects inherent in Lightning’s design create compelling dynamics for ecosystem growth. As more participants join the network and establish channels, routing reliability improves and payment paths become more efficient. This positive feedback loop incentivizes adoption and creates natural momentum toward network consolidation around well-connected nodes, though careful attention to decentralization remains necessary to preserve the system’s trust-minimized properties.

Ark: Scaling Through Coordination

Ark represents a significant architectural departure from Lightning’s peer-to-peer model, introducing a central service provider that coordinates transactions for multiple users within a shared UTXO structure. This is distinct from the previous systems in which all participants had the same role and permissions, the Ark Service Provider is a distinct participant. This approach enables scaling to much larger user bases without requiring direct channel relationships between all participants, addressing one of Lightning’s most significant operational challenges.

The system operates through periodic rounds during which the service provider collects pending transactions, creates a new shared UTXO structure, and settles all included payments atomically. In-round payments achieve finality within the round timeframe, typically measured in minutes rather than seconds. However, Ark also supports out-of-round payments that can settle immediately between cooperative parties, though these require additional coordination and may incur higher costs.

Privacy in Ark benefits significantly from the mixing effect of batched transactions within each round. External observers cannot easily determine which inputs correspond to which outputs within a round, providing transaction-level privacy superior to both on-chain and Lightning transactions. However, the service provider maintains complete visibility into user activities, creating a different privacy model that trades external privacy for operator transparency.

The trust model in Ark represents a carefully calibrated compromise between operational efficiency and user security. Users must trust the service provider for operational continuity and transaction coordination, but retain unilateral exit capabilities that ensure fund security even if the provider becomes uncooperative or disappears. This model enables the provider to offer enhanced user experience and operational simplicity while maintaining cryptographic guarantees about fund safety. In addition out-of-round payments also require trusting the ASP not to collude with the prior owner of the funds, until the round is completed and the agreement committed.

Ark’s economic efficiency excels particularly for scenarios involving many small payments between users who are not directly connected in Lightning. The batching approach amortizes on-chain costs across multiple transactions, making small payments economically viable even when Lightning routing would be unreliable or expensive. However, users must accept the timing constraints imposed by the round-based settlement model.

The relationship between Ark and Lightning demonstrates the complementary nature of Bitcoin payment systems. Ark can serve as an efficient onboarding mechanism for new users, providing simplified management while preserving exit options to Lightning or on-chain Bitcoin. Conversely, Lightning can provide instant settlement for time-sensitive payments that cannot wait for Ark’s round-based processing. Service providers can operate hybrid systems that leverage both protocols based on specific transaction requirements.

Statechains: Ownership Transfer Innovation

Statechains enable off-chain transfer of Bitcoin ownership through a coordinator that manages state transitions without accessing the underlying funds. This approach addresses specific use cases where ownership transfer rather than payment processing represents the primary requirement, such as trading scenarios or custodial arrangements that require verifiable ownership changes.

The system operates by creating a sequence of timelocked transactions that establish ownership rights over specific Bitcoin outputs. The coordinator facilitates ownership transfers by managing the sequence of signatures required to update ownership states, but cannot unilaterally access the underlying funds. This architecture enables immediate ownership transfer from the perspective of involved parties while maintaining cryptographic guarantees about ultimate fund control.

Privacy in statechains depends heavily on the coordinator’s information handling practices and the specific implementation details of state transition mechanisms. The coordinator necessarily observes ownership transfers, creating potential privacy vulnerabilities if this information is not properly protected or if the coordinator cooperates with external parties seeking transaction data.

Settlement finality in statechains presents an interesting duality. From the perspective of involved parties, ownership transfers achieve immediate finality through the coordinator’s state management. However, ultimate settlement still depends on on-chain transaction confirmation, creating a layered finality model where immediate operational finality exists alongside eventual cryptographic finality. This is comparable to Ark where the out-of-round payments required trusting the coordinator, until they get final confirmation when the round terminates.

The trust model in statechains requires users to trust the coordinator not to collude with previous owners to compromise current ownership claims. This trust requirement is more complex than simple custodial arrangements because it involves ongoing relationships between multiple parties rather than bilateral trust relationships. However, the coordinator’s inability to directly access funds provides important security guarantees that distinguish statechains from traditional custodial solutions.

Economic efficiency in statechains excels for ownership transfer scenarios because operational costs remain largely independent of transferred amounts. This characteristic makes the system particularly attractive for high-value transfers where the fixed coordination costs represent a small percentage of transaction value. However, the specialized nature of ownership transfer limits the system’s applicability to broader payment scenarios.

The integration potential between statechains and other Bitcoin payment systems presents interesting opportunities. Statechain outputs can potentially be used to fund Lightning channels or serve as backing assets for other payment protocols, creating hybrid arrangements that leverage statechains’ ownership transfer efficiency alongside other systems’ payment capabilities.

Chaumian Systems: Privacy Through Blind Signatures

Cashu and Fedimint represent different implementations of Chaumian blind signature protocols, prioritizing privacy and operational simplicity through cryptographic techniques that prevent custodians from linking deposits to withdrawals. These systems address use cases where privacy requirements outweigh concerns about custodial trust relationships, particularly for users who prioritize transaction confidentiality over complete self-custody, or for small payments that would be uneconomical in other systems.

Cashu operates through individual mints that issue blind signatures over Bitcoin deposits, creating tokens that can be transferred between users without revealing transaction details to the mint operator. The blind signature property ensures that even if the mint operator maintains complete transaction records, they cannot determine which specific deposits correspond to which withdrawals or transfers.

Fedimint employs a federated custody model where multiple parties collectively manage on-chain user funds through threshold cryptography, i.e., a majority of federation members sign off on transactions. This approach distributes trust across multiple custodians rather than concentrating it in a single entity, reducing the risk of unilateral fund seizure or loss while maintaining the privacy benefits of Chaumian protocols. This approach of reducing the trust in a single entity, by federating the trusted entity, has been successfully deployed in other systems such as Liquid in the past.

Privacy characteristics in both systems provide strong guarantees against external surveillance and internal monitoring by custodians. The cryptographic properties of blind signatures ensure that transaction linkability requires compromising the underlying cryptographic assumptions rather than simply analyzing transaction data. This represents a significant privacy improvement over both on-chain and Lightning transactions.

Settlement times in Chaumian systems depend on specific implementation details but generally achieve faster finality than on-chain transactions. Transfers within the system can achieve immediate finality, while interactions with external Bitcoin systems require coordination with the custodian or federation. The specific timing characteristics vary based on the operational policies of individual implementations.

Economic efficiency in these systems excels for small payments because the custodial model eliminates many of the per-transaction costs associated with on-chain settlement or Lightning channel management. However, users accept custodial risk in exchange for this efficiency, creating a different risk-return profile than self-custodial alternatives.

The trust requirements in Chaumian systems represent perhaps the most explicit acceptance of custodial relationships among all systems analyzed. Users must trust custodians or federations to maintain system solvency and honor withdrawal requests, though the privacy properties ensure that custodians cannot selectively censor specific users without broader system compromise.

My personal perspective on custodial solutions has evolved significantly through observing user adoption patterns. While developers often view custodial arrangements as compromises to be avoided, user behavior suggests that many prefer the simplicity and familiar user experience that custodial services provide. Rather than viewing this as user failure, the development community should recognize it as feedback on the complexity of non-custodial alternatives and strive to improve their usability while acknowledging that custodial solutions will likely remain part of the ecosystem.

Integration Dynamics and Network Effects

The apparent competition between these systems obscures their fundamental complementarity and the powerful network effects that emerge from their integration. Each approach optimizes for different requirements, creating a payment stack that collectively serves a broader range of use cases than any individual system could address alone. The key insight is that users need not choose between these systems exclusively but can leverage different protocols for different transaction types based on specific requirements.

Lightning Network’s role as connecting infrastructure proves particularly crucial in enabling this complementarity. The network’s atomic swap capabilities allow seamless value transfer between different protocols, creating fungibility between systems that might otherwise remain isolated. A user might receive payments through Cashu for privacy, transfer value to Ark for efficient batching, and then route through Lightning for instant settlement, all while maintaining interoperability with the underlying Bitcoin security model.

The economic dynamics between systems create natural market segmentation that enhances rather than undermines overall ecosystem utility. High-value, infrequent transfers naturally gravitate toward on-chain settlement where security justifies higher fees. Frequent micropayments between known parties benefit from Lightning’s instant settlement and low costs. Privacy-sensitive transactions find optimal solutions in Chaumian systems, while large-scale payment processing operations can leverage Ark’s batching efficiency.

This segmentation enables specialized optimization within each system while maintaining interoperability across the broader ecosystem. Developers can focus on excelling within specific use cases rather than attempting to solve all payment requirements within a single protocol. The result is a more robust and capable overall system than would be possible through monolithic approaches.

The network effects between systems also create powerful adoption incentives. As Lightning network connectivity improves, it enhances the utility of all connected systems by improving their interoperability and liquidity access. Similarly, as specialized systems like Ark or Cashu develop robust user bases, they create additional demand for Lightning routing services, strengthening the overall network.

Future Implications and Strategic Considerations

The evolution of Bitcoin’s payment stack suggests several important implications for stakeholders across the ecosystem. First, the diversity of approaches indicates that no single solution will likely dominate all use cases, implying that successful implementations will focus on excelling within specific market segments while maintaining interoperability with complementary systems.

Second, the role of Lightning as connecting infrastructure appears likely to strengthen over time as more specialized systems emerge. This dynamic suggests that Lightning development, integration and adoption should remain a priority even for organizations primarily focused on alternative approaches, as Lightning connectivity increasingly determines a system’s ability to access broader ecosystem liquidity and functionality.

Third, the trade-offs between different trust models appear to be resolving through market segmentation rather than convergence toward a single optimal approach. This suggests that successful ecosystem strategies should accommodate multiple trust models rather than attempting to eliminate alternatives that might serve important user constituencies.

Bitcoin, as well as the off-chain protocols we have considered, open up new regulatory opportunities. Where in the past financial intermediaries and service providers had to be trusted, and thus regulated not to act against the interests of their users, the reduction in trust directly leads to a system that requires less invasive regulation, because there is no way for the intermediary to misbehave. Though as we have seen in the analysis, this is not black and white, and each system needs to be carefully considered.

Conclusion

The Bitcoin payment ecosystem has evolved from a single on-chain mechanism into a sophisticated multi layered infrastructure that demonstrates remarkable architectural diversity while maintaining underlying coherence through shared security assumptions and interoperability protocols. This evolution reflects not fragmentation but maturation, as different approaches emerge to serve diverse market requirements while maintaining connectivity through the Lightning Network infrastructure.

The analysis reveals that these systems compete primarily at the margins while complementing each other across the broader spectrum of payment requirements. Lightning provides instant settlement for time sensitive transactions, Ark enables efficient batching for large-scale operations and for many end-users managing small amounts, statechains facilitate private ownership transfers, and Chaumian systems offer strong privacy guarantees for confidential transactions. Each system excels within its optimized use cases while contributing to overall ecosystem utility through interoperability.

Rather than selecting winners and losers among these approaches, the market will be adopting a portfolio approach that leverages each system’s strengths while mitigating individual weaknesses. This development suggests a future where Bitcoin’s utility extends far beyond its original conception, enabling a broad spectrum of financial applications through complementary payment technologies.

The continued development of this payment stack represents one of Bitcoin’s most significant achievements, transforming a novel cryptographic protocol into the foundation for a new financial infrastructure. As these systems mature and integrate more deeply, they collectively expand Bitcoin’s potential to serve as truly global, internet-native money capable of supporting the diverse requirements of modern economic activity. The key insight for stakeholders is that success in this ecosystem increasingly depends not on building the single best payment solution, but on building systems that excel within specific use cases while maintaining robust interoperability with the broader Bitcoin payment infrastructure.

The Swiss Bitcoin Institute promotes sound, independent research on Bitcoin. Opinions expressed by Fellows are theirs and do not necessarily reflect those of the Swiss Bitcoin Institute.